Simple payback period is routinely used as an ultimate ratio when it comes to selecting between energy projects. This practice may cost your company money in missed opportunities.

Simple payback period (SPP) is the simplest way to assess profitability of an investment project. Simply divide first year cost by first year savings and you get SPP of the project. SPP is measured in months or years. Some people use a term Return-of-Investment for the same ratio, because SPP reflects how long does it take to return the invested money.

Despite simplicity, we strongly advise against relying on SPP when choosing between energy projects.

Disadvantages of using SPP

Simplicity of SPP comes at cost:

- SPP only uses first year costs and savings. This would have been fine if your company was due to be closed by the end of the year.

- SPP does not account for project risks. Evaluation of project risks is whole another story.

- SPP does not account for the cost of financing.

What’s a better ratio to assess profitability of energy projects?

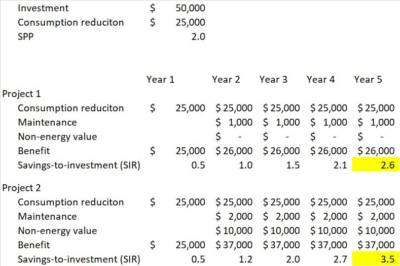

Leaving financing and risks aside, a much better ratio to evaluate profitability of energy projects is Savings-to-Investment ratio (SIR). SIR equals to a sum of project inflows and outflows divided by initial investment.

SIR shows how many dollars project will generate per $1 invested by Year X.

As such, SIR of a good project grows with years. A more profitable project has short SPP and high SIR. This ratio is better than SPP because it accounts for cash flows beyond Year 1.

Table below shows a simplified calculation of SIR for two projects with the same SPP, but different cash flows beyond Year 1. If a company were to choose Project 1 over Project 2, by Year 5 it would miss return of $0.9 on a $1 invested.

Read more about how disregard of appropriate ratios hurts energy projects in – http://www.greenq.ca/how-to-help-cfo-approve-your-energy-project-and-keep-healthy-margins/

Leave A Comment